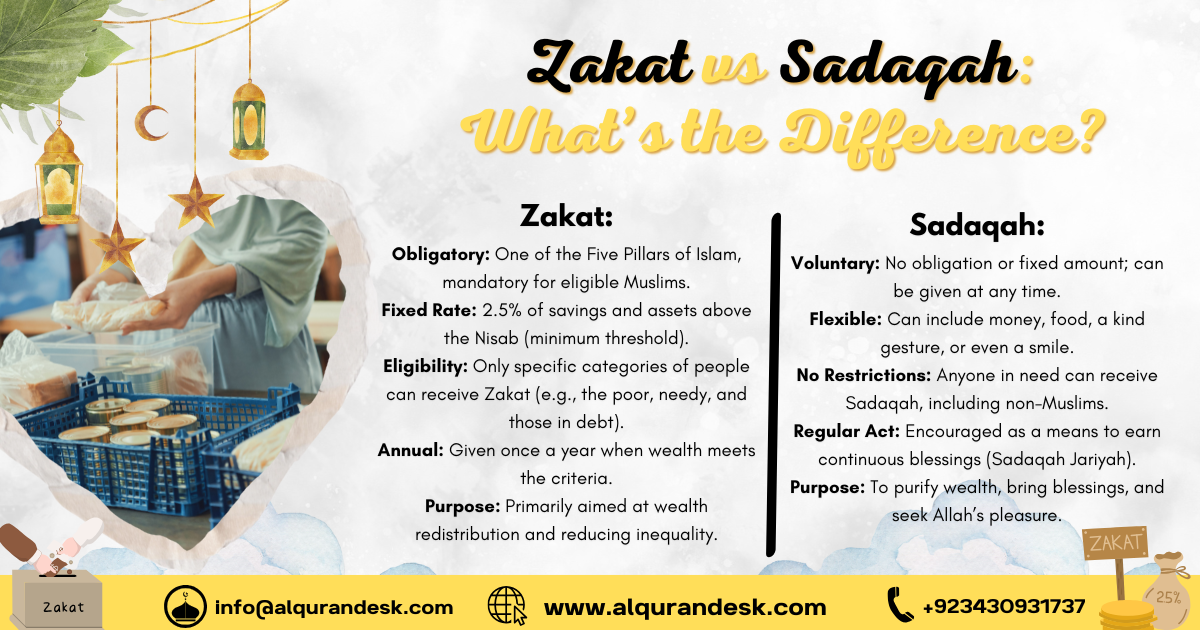

Zakat (زكاة) is one of the Five Pillars of Islam, which are the main duties every Muslim must follow. It is not just a form of charity but a special act of worship that helps cleanse our wealth and purify our hearts. The word Zakat comes from the Arabic word ‘zakā’, which means purification, growth, and blessing.

In Islam, Zakat is more than just helping others—it’s a command from Allah to make sure wealth is shared fairly in society. Muslims who meet certain financial conditions must give 2.5% of their savings and wealth every year to those in need. This includes the poor, the needy, and other deserving groups mentioned in the Quran.

Our beloved Prophet Muhammad (ﷺ) also taught us about the importance of Zakat:

“Islam is built on five pillars: Testifying that there is no god but Allah and that Muhammad is His servant and Messenger, establishing the prayer, giving Zakat, performing Hajj, and fasting in Ramadan.”

(Sahih Bukhari, 8)

By giving Zakat, we not only help those in need but also bring blessings and peace into our own lives.